Hedge Against The Inevitable With Gold

Below are a few different types of precious metals that are permissible in self directed IRAs. >>Visit the Official Augusta Precious Metals Site. Commingled storage of metals is when the vault holds one place of metals that belong to many different people. As one expert frames it; “you can own a bakery with your IRA, but you cannot be the baker. Easy: online portfolio lenders who specialize in landlord loans. » MORE: Are student loan debt relief services legit. It can protect you against inflation and market volatility.

12 GoldBroker: Best for International Customers

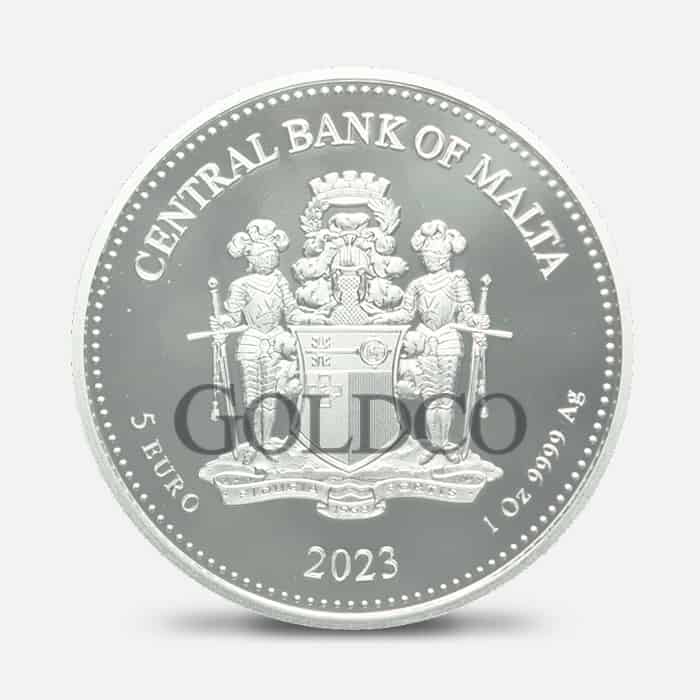

The team was so incredibly great to work with. With Lloyds Bank, you can choose to pay the loan back between 1 and 7 years. Both federal and state governments are cracking hard on the circulation of fake coins and bars, but the problem is not going away anytime soon. Therefore, the company has earned positive reviews and comments. Others like Goldco offer a promo like $10,000. Additionally, you should make sure that the broker or custodian you select has experience in dealing with gold and silver backed IRAs and is knowledgeable about the tax implications.

Commonly Asked Questions

Members should be aware that investment markets have inherent risks, and past performance does not assure future results. However, the initial RMD may be postponed until April 1 of the year following the calendar year. The debt www.outlookindia.com must be paid when the home is purchased. Its exceptional quality of service can be seen through the glowing reviews it has attracted on its website and other online platforms. STRATA Trust Company is not affiliated with and does not endorse or promote any precious metal dealer. Lear Capital is the perfect choice for those looking to invest in gold and silver IRA investments. As an Amazon Associate Retirement Living earns from qualifying purchases. While traditional IRAs typically consist of stocks, bonds, and mutual funds, some investors seek to diversify their portfolios by including precious metals.

Methodology

Though IRAs were once limited to only holding American Eagle products, today, IRAs include all IRS permitted gold, silver, platinum and palladium products. Once you find the right financial institution for your SDIRA, you will need to choose between a traditional IRA or a Roth IRA 401k type of account. They have not received any complaints from the BBB since the company was established over a decade ago. It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. If you are thinking about investing in precious metals through your Individual Retirement Account, you must understand how the IRS treats gold. Finally, the investor can monitor the value of their gold silver IRA through their custodian and make decisions about buying or selling precious metals based on market trends. It is safe and effective because it permits them to obtain information about your account but DOES NOT authorize them to invest or sell without your approved permission.

How To Get Started

IRA amount options: $25,000 $1,000,000. STRATA does not conduct a due diligence review of any precious metal dealer. With years of experience in the precious metals industry and a strong focus on providing excellent customer service, RC Bullion offers a wide selection of gold IRA products and services to meet the needs of its clients. If you’d like to talk to someone about setting up a precious metal IRA or transferring funds from an existing IRA, please call1 844 754 1349 with no obligation. After you’ve made your selection, the metals are shipped to the depository and stored. To make it easier, we have designed a ranking system that helps you determine the best gold investment companies for those wanting to invest in gold IRAs. Orion recommends you store precious metals at a local Brinks or Delaware Depository location. This loan program is subject to change without notice. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. With a team of knowledgeable and experienced professionals, Augusta Precious Metals provides customers with quality service and guidance when it comes to gold IRA investments. The IRS requires that your IRA account administrator do the actual transactions on your behalf. Gold and Silver IRAs are a great way to save for retirement.

Our Latest Thinking

BBB: A+ From 441 Reviews. Some highlights include. They specialize in providing a full range of gold IRA services, from helping clients set up their accounts to providing expert guidance on investing in gold. Another advantage is that it stores your gold in insured depositories e. According to the Bureau of Labor Statistics, approximately 60% of jobs in 2014 were held by workers without a four year degree. They must have a firm grasp of the rules, guidelines, and types of precious metals that qualify. This can be a great way to diversify an existing retirement portfolio and take advantage of the potential benefits of gold as an investment. Coins and bars are the most common gold types used in IRAs. The self directed portion means that you can put whatever approved assets you wish to buy in your IRA, as you control what goes into the account This means you could put any approved forms of precious metals into this plan. I worked in high tech jobs for 20+ years before deciding to make a jump to starting my own business and I always tell people that trust is the MOST important thing to me over anything else. They operate in total transparency, recognizing the value of IRAs and making suggestions based on their benefits to customers. Any Gold IRA stored at home could be subject to an IRS tax penalty of 10%, so it’s worth your while to store your gold or precious metal investments in an IRS approved facility. Unlike a traditional IRA which can be easily handled by a custodian, the setting up of a precious metals IRA is a more rigorous and specialized process. Based on IRS rules, you must hold your Gold and other precious metals in a secure, IRS approved storage facility.

Types Of Gold You Can Hold In A Precious Metals IRA

However, there is a yearly maintenance fee of $180. Be sure that you know the exact amount of the transfer and confirm it with the provider in order to avoid any unexpected issues. The company’s silver IRA services are backed by a knowledgeable team that provides superior customer support, ensuring that clients are provided with the best possible service. It allows the value of your gold to grow tax free gold Roth IRA or tax deferred gold Traditional IRA. That changed in 1997 when the IRS permitted coins from other countries to be used in US IRAs. Note: Bullion is not legal tender. Silver IRA investments have become increasingly popular in recent years due to their stability and potential for growth.

Gold Alliance: Cons Gold and Silver IRA

Bank of Maharashtra offers eligible customers home loans with interest rates starting from 8. The IRS doesn’t have minimum investments, but it does have annual maximums. A lot of people are turning to the safety and security of precious metals as an investment option. “Our salespeople are relieved when they find out a client has chosen Equity Trust for their custodian, because they know the transaction will be speedy, simple, and headache free. Augusta has a minimum investment fee of $50,000 for IRAs. >> Read More: How does a gold IRA work. They’ll need to make sure that all assets are really yours and that they are traceable. Professionals know how to deal with clients, and they’re supposed to do everything they can to help them. If you choose to do business with this business, please let the business know that you contacted BBB for a BBB Business Profile. Q: Can I hold other assets besides gold and silver in a gold and silver IRA. However, gold IRA minimum investment requirements can range from $2,000 to $50,000, not including fees. With knowledgeable staff and straightforward fees, Lear Capital is a great choice for those looking to invest in gold.

Best for customer service: Lear Capital

Keep in mind that you cannot fund your new IRA with precious metals that you already own, or that might be given to you by family or friends. Your IRA can hold gold, silver, platinum, and palladium. They have a wide selection of silver coins and bars, and their rates are competitive. Rental loans are designed for a longer time horizon. Disclaimer: The above is a sponsored post, the views expressed are those of the sponsor/author and do not represent the stand and views of Outlook Editorial. We also requested starter kits, as most companies allow interested investors to call for a starter kit or more information. A precious metals IRA account can potentially be a great way to accumulate precious metals within a portfolio. Having problems—give us a call and we can discuss together. Augusta Precious Metals will store your gold IRA investment through Delaware Depository, one of the best private depositories in the U. Real time gold prices. Only if you live in one of the following community property states. Look no further than Augusta Precious Metals.

American Silver Eagle Coins

We remit settlement via bank wire to your custodian within 24 business hours of receiving your precious metals. Money Reserve Review. With a team of highly trained professionals, these companies can provide customers with the best advice and guidance when it comes to investing in gold. Most analysts agree that silver remains a safe bet. Most of Lear Capital’s customers have existing retirement accounts they wish to diversify with gold and silver, but the company will assist anyone with an IRA or 401k rollover. Their commitment to customer satisfaction makes them a top choice for gold IRA investors looking for the best custodian for their investments. Like other top gold IRA suppliers, Birch Gold Group provides a free information pack and an extensive range of actual gold items. Patriot Gold Club is a trusted provider of silver IRA services. The IRS requires the assets in your retirement account to be held by a third party. American Hartford Gold has been in operation since 2015, with Sanford Mann at the lead.

Apr 25, 2023

Finally, keep in mind that the benefits of storing your gold at home are limited. The company’s financial advisors are knowledgeable, experienced, and always available to provide assistance and advice. Every sales rep knows that manual admin work is the biggest productivity killer. Precious metals and rare coins are speculative purchases and involve substantial risks. They must have a firm grasp of the rules, guidelines, and types of precious metals that qualify. A self directed IRA is different from other types of IRAs because you can invest in assets like real estate and precious metals. This company has risen to the top because of its commitment to making the investment process simple and transparent. 59% fee on the total amount. They also offer a wide range of products and services, ranging from gold and silver coins to IRA accounts.

Gold Bars

Track your gold transactions to meet IRS requirements. American Palladium Eagles. Physical metals fall into two categories: 1 bullion, which are coins or bars of a specific weight and purity; and 2 “numismatic” or collectible coins, which can be rare or old coins, or special proofs that are newly minted as collectibles. Popular bars or proof coins include Canadian Maple Leaf, Credit Suisse – Pamp Suisse Bars of 0. Disclaimer: This is sponsored content. A broker or custodian is essential when it comes to investing in a silver based IRA. Searching for the best gold IRA companies can be a daunting task. Click Here to Learn More About American Hartford Gold. Gold IRAs receive similar tax advantages as other IRAs. At Red Rock Secured, you can only set up an account with a minimum of $10,000 for which you have to pay an annual service fee of $150. Orion Metal Exchange is a scrap metal yard and recycling facility located in the Greater Toronto Area. IRA Term Options: 6 Months, 12 Months, 24 Months, 36 Months. The best gold IRA companies will have a team of knowledgeable advisors who can help investors make informed decisions.

GOLD PRODUCTS

Setup is fast and directed by your customer service representative. As a taxpayer, you also have to pay taxes on your IRA funds so understanding what you owe is essential. Their range of precious metal IRA options allows investors to diversify their portfolios and safeguard their wealth against economic uncertainties. Find retirement peace of mind with gold IRAs. Their commitment to providing quality services and reliable advice has earned them a great reputation in the industry. GoldCo: A Trustworthy Silver IRA Company for Your Retirement Plan. All gold IRA rollovers must follow the same tax rules for funds rolled into a traditional or Roth IRA. You’ll receive payment confirmation from Money Metals Exchange and be able to track your shipment all the way to the depository. Oxford Gold Group is an outstanding choice for those seeking to invest in gold. High minimum deposit — $50,000. The FCA answers to the UK Parliament and has the ability to pursue criminal action against companies that violate its standards. Stocks fluctuate every second of every day and are highly dependable on consumer and business trends. When looking for silver IRA companies, it’s important to do your research and choose a reputable company that meets your specific needs. With 90,000+ happy customers, Lear Capital is a company you can trust.

Precious Metals IRA – Frequently Asked Questions

We are never in conflict with your investment decisions because we do not endorse or sell any investment products. They provide a safe and secure way to invest in gold and silver, giving customers peace of mind that their investments are in good hands. When considering different accounts, here are a few things to consider. The company specializes in selling gold and silver coins, bars, and bullion. A: Bullion held in an IRA must be held by a depository or storage provider such as BullionStar. There are different companies to consider when it comes to gold investments and opening a retirement account. These companies also have a reputation for being trustworthy and transparent in their dealings with clients. All metals purchased from these custodians are stored and safeguarded in the Delaware depository.

Precious Metal Investing in a Hot Market

Receive up to 10% in free silver with qualified accounts. The higher your investment into the gold IRA, the lower your fees. Do you want to grow your wealth or protect it. Make sure the custodian or broker is registered with the Financial Industry Regulatory Authority FINRA and has the proper licenses. “Working with Mandi Carlson to make the BEST investment was an enjoyable and efficient experience. GoldCo Precious Metals IRA 2. The shipping prices vary based on the products, weight, and shipping location. 5 years old, the IRS will impose a 10% penalty for early withdrawal. After analyzing several customer reviews, we found that they love their investor education program.

ReadLocal

When researching silver IRA companies, it’s important to look for ones that have a strong reputation in the industry and are known for their robustness and security measures to protect your investments. Monitor your investment: You can contact your precious metals specialist at any time for updates about your investments and to receive an up to date buy back quote. The Experts at Midas Gold Group can also help you convert other retirement plans to physical silver. Goldco is known for treating all its customers with its “white glove service” from the start. Discover Quality Precious Metals at Augusta Precious Metals Buy Now and Enjoy Exceptional Value. They offer their clients a variety of options ranging from gold and silver IRA eligible coins, gold and silver Bullion, and premium gold and silver. These are products that we have used ourselves and recommend wholeheartedly. Buybacks can give you peace of mind, knowing that you won’t end up stuck with your gold if you no longer want it. To learn more about the company, read our Gold Financial Group Review. Experience Oxford Gold’s Excellence Try It Now.

Discipline

Best for Investor Education Program. When it comes to investing in your retirement, a gold IRA is a popular and secure option. The demand for this precious metal has never been higher, as investors see it as a safe haven during economic turmoil or political conflict worldwide. With their silver IRA services, Noble Gold ensures that customers can confidently invest in silver as part of their retirement portfolio. You can invest in a precious metals IRA with Birch Gold Group by following these steps. You’re also not locked into a predetermined asset group chosen by your account’s custodian. Our long term focus on the safety and soundness of our enterprise helped us weather difficult economic conditions in Q1 2023. Additionally, some gold IRA companies offer additional services such as storage and insurance.

Los Angeles, USA

We’ve added them to our list due to. The IRS must approve the depository for that explicit purpose. On the back of the coin is shown the weight in ounces “ONE TROY OUNCE”. We’ve completed over $1 billion in trusted transactions. The precious metal market has inherent risks. I would recommend these folks 100x over. You can rollover money from a Roth IRA to a Gold IRA without any tax consequences. Goldco has received almost perfect gold IRA reviews on websites such as Trustpilot and Consumer Affairs due to its strong commitment to satisfying its customers.